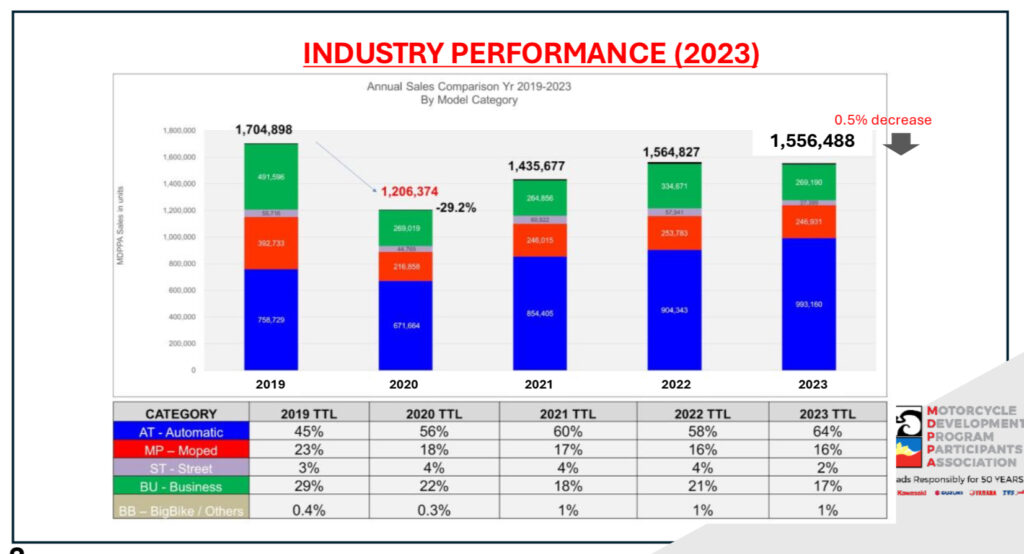

PH motorcycle sales down by .5% in 2023, projected growth for 2023 remains consevative

As the Philippine economy shows signs of recovery with a 5.6% GDP growth in 2023, the local motorcycle industry charts a slightly different course. The Motorcycle Development Program Participants Association Inc. (MDPPA) reported a -0.5% sales growth for the previous year, marking a downward trend. Total unit sales, which stood at 1,564,547 in 2022, dipped slightly to 1,556,488 units in 2023. This comes after a notable resurgence in 2021, following the pandemic-induced slump of 2020, where sales plummeted to 1,206,374 units.

Among the MDPPA’s sales in 2023, over half of the units sold were Automatic Transmission (AT) motorcycles, commonly known as scooters. Initially favored by first-time buyers for their ease of operation, scooters have recently gained traction in the delivery services sector. The sale of new AT units reached 993,160, constituting 64% of total sales for 2023.

Following closely behind are Business Unit (BU) motorcycles, comprising 17% of last year’s sales with 246,931 units sold. Primarily intended for commercial use, BU models are often converted into tricycle units for passenger transport, while some are employed for heavy-duty delivery services.

Mopeds (MP) made up 16% of sales, totaling 269,190 units. Positioned as the most affordable option in the market, save for a few sport-oriented models, Mopeds cater to the price-sensitive commuter segment.

Standard (ST) motorcycle models sold more conservatively at 37,399 units. Considered a step-up from entry-level commuter bikes, STs also serve as an entry point to the Big Bike (BB) segment, which saw the sale of 9,381 units last year, along with 427 recreational off-road vehicles.

In comparison to 2022, sales of BU and ST categories decreased by 4% (65,000 units) and 2% (20,000 units) respectively, while MP and BB categories saw increases of 7,000 and 3,000 units respectively.

Reflecting on the regional landscape, Mr. Alexander Cumpas, President of MDPPA, noted a mixed bag of outcomes for ASEAN member countries in 2023. Indonesia and Thailand experienced growth of 20% and 4% respectively compared to their 2022 figures, while Vietnam and Malaysia faced declines of 16% and 20%. The Philippine market positioned itself in the middle with a marginal drop of 0.5% compared to 2022.

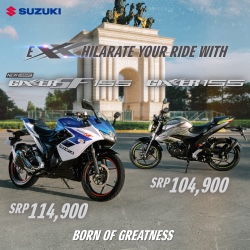

Looking ahead, the MDPPA projects a 2% sales growth for 2024. Collaborating with member brands Honda, Kawasaki, Suzuki, Yamaha, and TVS, the association remains steadfast in its commitment to providing safe and affordable transportation options for Filipino riders. With half a century of responsible road riding behind them, these manufacturers are poised to navigate the challenges and opportunities that lie ahead in the evolving landscape of the motorcycle industry.

0 comments